$AMPY

It must be a good idea if it compelled me to use Substack, right?

At current Strip pricing, I believe AMPY represents one of the most attractive risk/reward opportunities I have encountered. Every day that Oil & Gas prices stay at these levels is a day where this stock is criminally undervalued. By simply rolling 3x EV/EBITDA forward to 2023, I believe the stock can appreciate to $9 (2.4x) without any contribution from efficient capital allocation. If management decides to repurchase shares up to $6/share and maintains 1x of net leverage, shares could trade for $12, a >3.2x return versus current stock price. Please read that again. At 3x EV/EBITDA, I could see a >3x return within 18-24 months.

A 3x EBITDA multiple, really? That $9/$12 share price I referenced above jumps to $12/$18 at 4x EBITDA. Why in the world should a stock with manageable leverage and low decline asset base trade at 3x EBITDA?

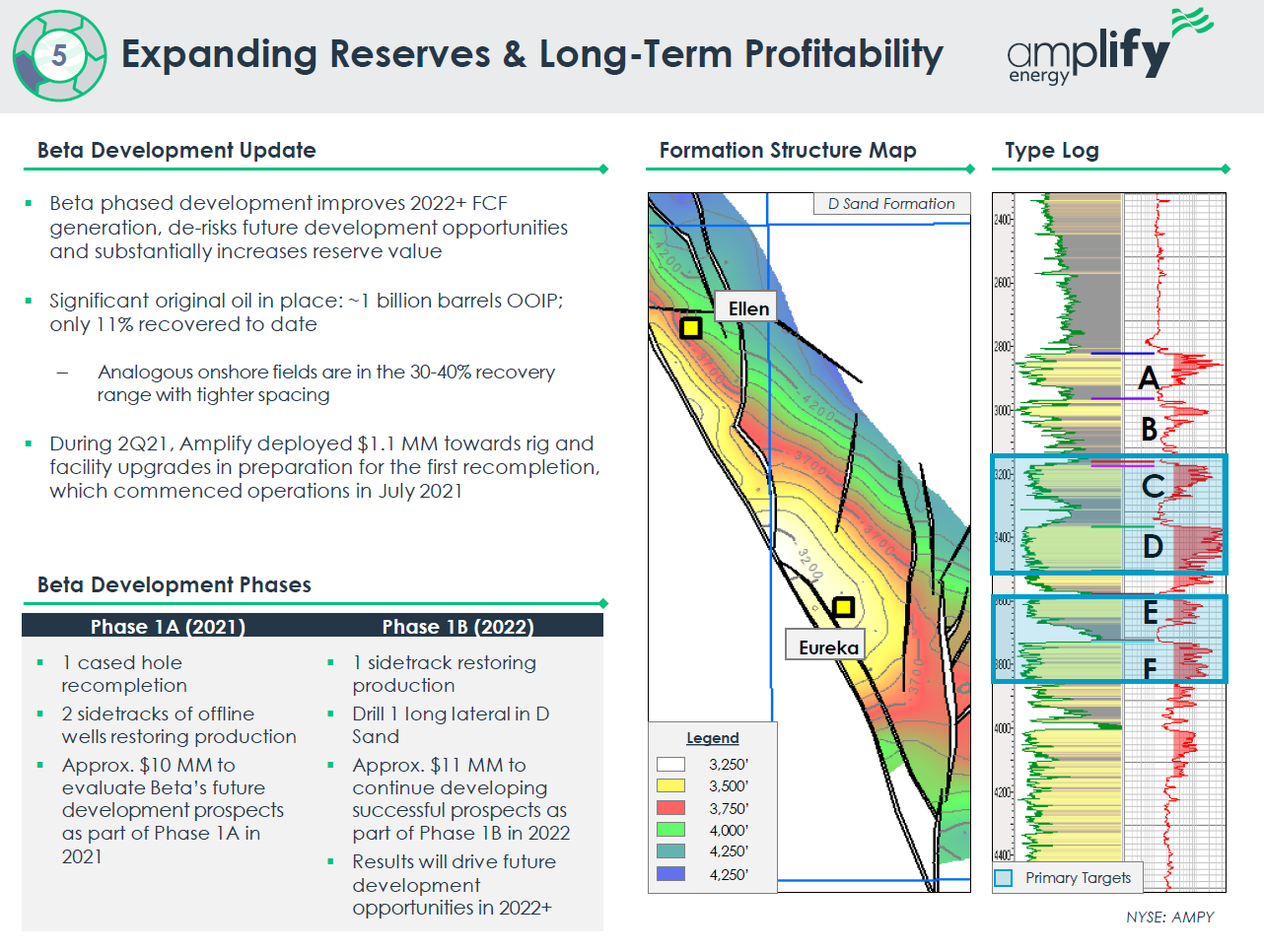

The company is currently drilling at its Beta asset with the goal of adding low ($5/LOE) marginal cost barrels of Oil to its existing production base. While I have run $50M in capex through my model in ‘22 and ‘23 to account for this incremental exploration, I have not added incremental barrels. If the drilling produces a measly 500 barrels per day, we are adding $30M of equity value on a $140M base. If we are somewhat more successful and find 2,000 barrels per day (I believe management aspirations are greater), we have created… checks notes… $110M of incremental value at 3x EBITDA, not that far away from the entire current market cap of the company.

While I fully acknowledge that there are low valuations across many commodity equities, I would encourage the reader to appreciate the fact that $62 Oil (current '23 Strip) is smack in the middle of its long-term distribution (45th percentile since 2005), in stark contrast to subsectors like Steel, Coal, Copper etc which are at or close to all-time highs, and thus the bear case of "you're just a tourist paying a low multiple on peak earnings" is rather suspect. I hesitate to even run higher prices through the model because the results just get silly…. but let’s just get silly for a second here. If I were to add $10/$20 to my Oil assumption in 2023 ($72/$82 instead of current Strip which is at $62), the $9/$12 price targets in the Cash Build versus Buy Stock scenarios go to $12/$21 per share at $72 Oil and $15/$39 at $82.

“But twebs, I think Oil could go to $100.” Sorry, that breaks my model because we repurchase more than the entire float. “But twebs, isn’t the stock a zero at $50 Oil? Nope, still worth $6 at 3x EBITDA. Why? ‘22 is hedged and you’re going to do close to $70M of FCF - so get your ‘what if prices immediately crater’ thesis out of here. But twebs… Ok fine, I can get the model to spit out a $4 price target at $46 Oil ($42 realized). If you are still reading this and you think Oil is going to $46, just GET OUT. If you think Oil is going below $46, well then…

This opportunity is hiding in plain sight for a few different reasons, none of which are particularly concerning to me. First, the company carries a bit more leverage than some of its peers; the capital structure is entirely comprised of a $245M RBL facility (Nov ‘23 maturity) which hamstrings capital return until either mid-2022 or an asset sale. Second, the assets are somewhat higher cost, which means sensitivity to a lower price deck is meaningful. Third, at $140M market cap and less than $2M of average daily volume, there is no natural owner of the stock, and I don't need to remind anybody reading that this is a somewhat unloved sector (for now). The first two points are a double edged sword - of course we would all love debt free assets at the bottom of the cost curve, but the embedded operational and financial leverage is the reason there is so much convexity in the idea. On the third point, I have found that when the cash is doing the talking, you don’t need to worry about shareholder dynamics as much.

Background - A Low Decline Set of Disparate Assets

By way of background, I became increasingly bullish on commodities last year (but Oil specifically) for a few different reasons. First, US production does seem to be permanently impacted by the failure of the high-reinvestment rate Shale model. There are basically zero public companies who aren’t on the ‘disciplined capex and capital return’ train, and this is showing up in a slower recovery in rig count, among many other indicators. This implicitly pushed the cost curve up as you had a big chunk of supply that was using ‘fantasy’ production costs to justify their continued exploration. This is gone. When the shale treadmill is not running, Opec behaves, which is not an insignificant consideration. Second, we really do seem to have learned our lesson with the anemic recovery post GFC, and global policymakers are taking much more of a ‘run it hot’ approach to the economy. When you combine this with fiscal policy supporting the lower end consumer (with their substantially higher marginal propensity to consume), you have a recipe for strong demand growth. I could go on and on but the point is that my macro view made me bullish on Oil.

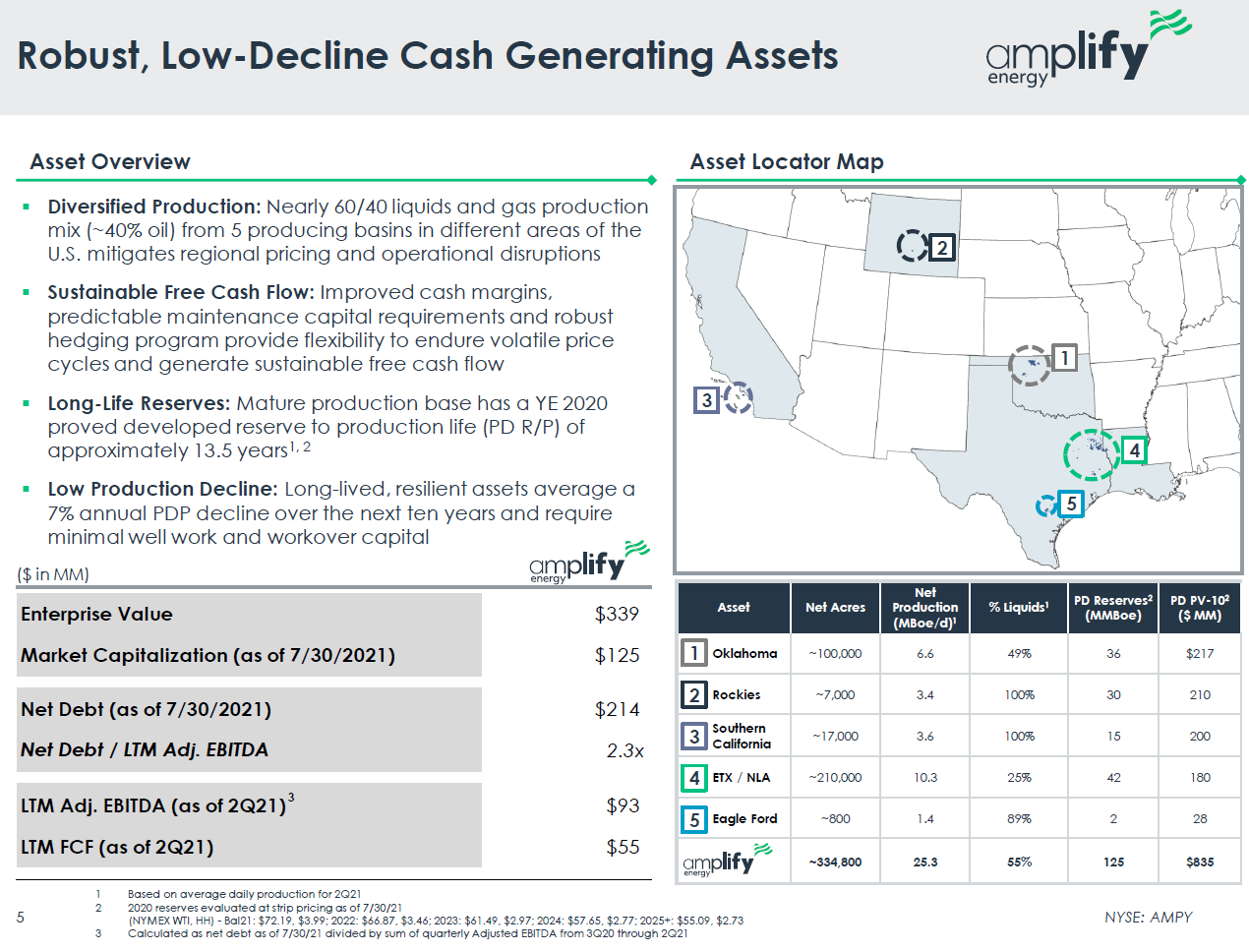

Great, you have a positive macro view, this is an incredibly scary sector for generalists. Yes - I am eyes wide open that there is a ton of latitude in reserve reports, decline curves, stated exploration costs, reinvestment rates, you name it. So I went looking for a company that was cash generative on maintenance levels of capex where production wouldn’t implode. This is essentially the thesis with AMPY. Not the lowest point on the cost curve, but low decline assets that don’t require a ton of maintenance capex. This slide from the management deck does the story more justice than my words, so I’ll paste below (btw this CFO does an epic job of communicating the story with a small team)

One further note - we are basically stress testing this low decline thesis as we speak. Management cut capex to the bone due to Covid, and decline rates have been quite reasonable - a bit heavier on the gas side but perfectly reasonable on the Oil assets which represent 67% of ‘22 revenue. Further, further note, I expect gas production could actually flatten out in ‘22 as the company continues its workover program and gas prices support drilling that would have been unprofitable in the 2’s.

The Opportunity

Once you are able to move past the 'why is this opportunity available' thought exercise, you come to the realization that the financial and operating leverage are creating a PE-like setup in the stock, where cash flow, debt paydown and time are going to produce incredibly high IRRs in a flat commodity price environment. We can debate whether the stock will price in any of this before the hard catalyst of capital return - in my view, the math is so obvious that it shouldn't be necessary to wait until capital returns, but microcaps have a way of waiting until the absolute last moment to reprice - we shall see.

First, the basic maths (I put this in here so that you can ponder whether I am Australian). AMPY currently carries an EV which is comprised of $140M of equity market cap ($3.68 stock price) and $216M of net debt, which should fall to $185M by year-end. The RBL lenders insist on a very large hedge program, which was great in 2020 and terrible in 2021, so we will be selling Oil this year sub $50. As we progress into '22 hedges were placed in an improving environment and thus we should realize just over $55 Oil in '22 (Strip is $64 but we are 82% hedged at $57 and there is ~$3.75 of basis). I am modeling $2.55 gas, which is comprised of 90% hedged position at $2.88, 15% basis to Henry Hub and 10% at Strip of $4.12.

As we look to '23, hedges are substantially lower and thus there will be much cleaner exposure to the current pricing environment. This is all a long way of saying that as you build your model, you are going to realize higher prices in '22 and '23 than '21, and this is resulting in a pretty substantial uplift in EBITDA on a stock that already looks silly on '21. For perspective, I have $55/$58 $2.55/$2.98 realized Oil and Gas in '22 and '23 and this is resulting in $127M/$128M of EBITDA in these 2 years compared to $102M in ‘21. 3x EBITDA on current year is already silly, but as you start to increase EBITDA and pay down debt in your model, the valuation on '23 is a complete and utter joke. Just as a thought exercise (because I do not believe this is the smartest capital allocation decision), if you use all FCF in '22 and '23 to pay down debt, you end '23 at $43M of net debt. So the 3x EV/EBITDA multiple that is already a joke, becomes an hour long Chris Rock "Bring the Pain" standup routine greatest joke of all time. I will remind the reader that '22 is almost fully hedged and '23 Strip for Oil is basically in line with the 5/10/15 year average of the commodity. And you are paying, 'checks notes' 1.4x/EBITDA and this assumes no progress at Beta

I think the best way to outline the convexity in the story is to simply model out '22 and '23 and assume either a range of EBITDA multiples between 3x-5x. “But twebs, you can’t use EBITDA multiples in Energy?!”. We have already covered this above, it’s actually a fine proxy when maintenance capex needs are reasonable. If you really want to quibble, management has some great slides on equity value at various level of PD PV10, PUDs etc, whose conclusions are basically bang in line with what I’m saying.

You need to make an assumption on use of excess cash, and while I think it would be insane not to buy back every share possible as soon as possible, I have run the model under a range of scenarios - buyback, building cash, and a mix in between. Here are some scenario tables. Enjoy.

First, we have our ‘do nothing’ model, which just piles up the cash flow generated through ‘23. Of note, I am modeling $191M of free cash flow from ‘21 through ‘23, which is very close to the “Illustrative Free Cash Flow Profile” management provided in the last earnings deck. NB - I am actually a touch below management, probably due to ramping capex in the model.

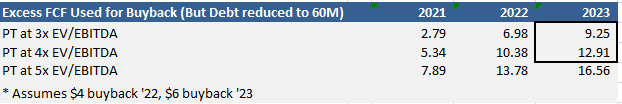

Second, we have our ‘pay down debt to $60M’ model, which frees up some excess cash in ‘23 for share buyback. We then buy shares at $6 in ‘23.

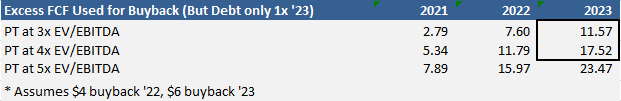

Third, and this is what I hope happens, is our “Leave 1x of leverage on the business” model. We pay down debt to $135M by year-end ‘23, and use the excess cash to buy back a $hit-ton (technical term) of stock at $4/$6. This shrinks share count by 44% as we buy 8M shares in ‘22 and 9M shares in ‘23 at $4/$6 per share. This is your ‘perfect scenario’ i.e. the stock stays low long enough to retire a ton of shares at a crazy discount to intrinsic value.

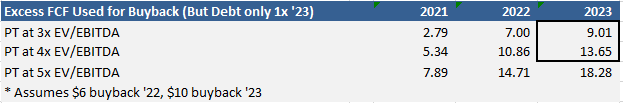

Of course, the world is never perfect, so here is a sense for what happens if/when the stock starts running, and you are buying shares at $6/$10 rather than $4/$6. As you can see by comparing to the ‘do nothing’ and ‘pay down to $60M’ scenarios above, $10 is where you will start to run into having a lot less firepower on the buyback (and perhaps at that time M&A or a special dividend might make more sense - but we can cross that bridge when we get there)

The Kicker 1: Capital Returns as the Obvious Catalyst Path

“Any idiot on Twitter can point out that a stock trades at a discount to intrinsic value. Now tell me how that gap is going to close”. It’s a fair point - there are Met Coal and Steel stocks with a 1x handle EBITDA multiple right now, Lumber and Copper stocks in the 2's to 3’s. You have to have a catalyst path to pick one security over another. I believe the transcript of the last earnings call gave a few very strong morsels around this path, not to mention that it was just good/proactive shareholder communication. It is my view that once the capital return path is clear and turned on, the overhang that is keeping the stock at silly levels will be removed.

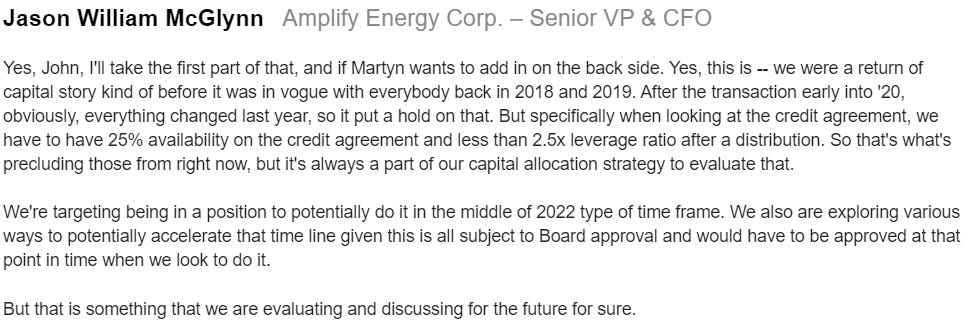

So what happened on the last conference call? Well, the CFO and CEO basically gave a 1-2 punch that laid out that a)they are very well aware of what is standing in the way of capital returns and b)may look for creative solutions to remove the bottleneck. First, the CFO describing the RBL limitations but reiterating the aspiration to return capital.

Then, the CEO proactively mentions a specific asset which could accelerate our timeline.

The Kicker 2: Beta - Low LOE Incremental Barrels

I am not even close to an expert on the chances of success at Beta, but the company does have a few things going for it. First, they have a long history of operating this asset and they are investing scarce capital against the opportunity. Second, there is capacity on their current platform that is 10x greater than current production, so incremental production will be quite low cost (management have guided to $5/LOE). Finally, I will just note that Beta results could serve as another potential catalyst - it is likely that management can communicate some early indications of success even before we are in capital return mode. Every 1K barrels of flowing oil is worth $19M of incremental EBITDA per year, so even small success would be quite material to the outlook. Please note that Beta results should only be incremental to the price targets I have outlined above, as I have included a ramp in capex but no incremental production in the model.

That’s it for now. To summarize, I think this opportunity is incredibly convex and time is on your side. The leverage to higher prices is immense, but this could also be a multi-bagger in a flat environment. It has been a while since I’ve properly written up an investment idea, so I apologize in advance for any grammar or formatting errors. I am happy to engage and debate as long as you keep it clean.

In re: both questions re: call options, I don't trade options for various reasons, the biggest one being I don't love being boxed in from a timing perspective. On AMPY, separately, implied vol is so high that you have to see massive upside in the stock before you start to make money, and I'm not sure that there is a ton of liquidity in anything long-dated.

Great write-up and podcast. Are you surprised that the stock didn't react positively to the Q3 earnings?

Three questions going forward for you:

- How much in EBITDA do you think Beta would have done in FY21 that would be eligible for lost income insurance?

- What happens with the Beta ARO liability if CA somehow never allows the asset to operate again? Does it accelerate the balance sheet liability if they are forced to plug the holes today (or when the lawsuits finally end) instead of a decade or two in the future?

- Do you think mgmt. will sell assets? If so, which do you think are mostly likely and at what price?