Summary

Thermal Coal - I get it. It's bad for the environment. We need to transition away from it as soon as possible. Coal fired power generation is shutting down. Regulators could screw you in ways you have not fully contemplated. Check, check, check. For a business that seems to be somewhat terminal, I can fully understand why the market may place an eye-opening, low single digit multiple on EBITDA, notwithstanding the amazing current economics at the mines.

... but Metallurgical Coal? Integral to the steelmaking process. Geologically scarce at the higher end of the quality spectrum. Blast furnaces are losing market share over time but we are still building new BF capacity. Very far from terminal. Check, check, check. So why is the market basically valuing ARCH as if its cash flows are worse than terminal in 2-4 years, despite its 14 years of high quality Met Coal reserve life? I struggle to find the right superlatives to describe how crazy the valuation is here. Here are a few:

The equity market cap is $1.3B at $79, and I expect $130M of net debt at year-end. My $155 Met case has $1.1B of EBITDA in ‘22, and the company will pay zero cash tax due to the NOL, AND ‘21 marks the end of the capex cycle, so $1.1B of EBITDA will turn into $1B of free cash flow.

The $400M capital cost Leer South mine will likely pay off in well under a year at prevailing market prices.

This one might be my favorite. At current spot prices into China, ARCH could make somewhere between $20M-$30M of EBITDA on ONE Panamax vessel, assuming 75K tons.

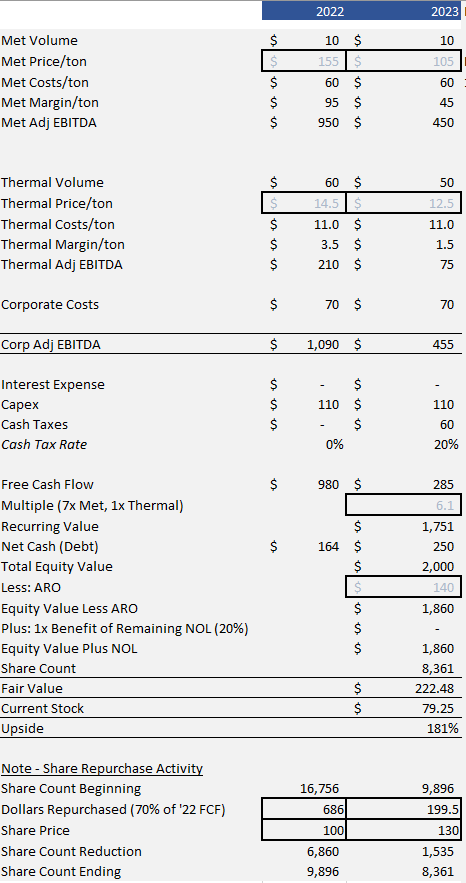

To work through various scenarios, I will explicitly model the supernormal profits and provide sensitivities around realized pricing and uses of cash through '22, and then transition the company to a normalized operating environment in '23. To state my conclusion first, the stock seems undervalued even if the supernormal period does not happen at all, and I see the potential for explosive upside if either spot prices stay stronger for longer, or the company is able to scoop up shares at anything close to current prices with all this excess cash flow. The combination of both could result in a five-bagger of the stock, whereas 'somewhere in between' is spitting out a triple as a YE '23 price target.

Background

I will try to make this as brief as possible. ARCH is transitioning towards becoming a pure play Metallurgical coal producer, with a cost structure that sits low enough on the cost curve that the company still did positive EBITDA as pricing imploded in 2020. The company has a stated intent to wind down its Thermal assets, and they have the great fortune to get one last supernormal period of profits as they wind down, based on what we are seeing in spot Powder River Basin prices.

ARCH will come out the other end of their supernova with 121M remaining tons of Metallurgical coal reserves which would do between $4B-$5B of future EBITDA and $3B-$4B of free cash flow in a normalized pricing environment. The market is telling you that those remaining assets are basically worthless, because I believe the company will cash flow something close to their current EV in the next 6 quarters.

Valuation

I simply model out three different scenarios here and then let's talk about why I believe you can justify potentially explosive price targets at realizing pricing wayyyyy below the spot prices you are seeing on your screen.

Scenario 1 basically says the supernova doesn't happen. I simply run $105 of Met and $12.50 thermal pricing through '22 and '23, buy back stock with 70% of free cash flow (assuming $90/$110 share price), work the ARO down to $140M, slap a 6.1x recurring free cash flow multiple on normalized earnings and spit out a price target. I get to $147, which is pretty insane given the stock is still at $79 even after the current run. I think the market is asleep at the wheel on the setup here. You have a company exiting an investment phase (Leer South cost more than $400M) and entering a harvest period. Free cash flow is close to $300M/$17 per share in a normalized environment, and this company repurchased $800M of stock not that long ago. This would be a juicy setup if pricing did nothing more than sit at normalized levels!

Scenario 2 takes Met pricing to $155 and PRB pricing to $14.50 for 2022 (this compares to USEC and PRB on the screen at $390 and $17 respectively). So as to not be a total pig, I will increase the buyback price to $100 and $130 in '22 and '23. This takes our price target to $222, up 180% versus last price. This is where capital allocation starts to really impact the convexity. If I were to assume no buyback and just stack the cash, my price target would be $164.

Scenario 3 - Let’s have some fun. I take Met to $205 and leave Thermal at $14.50. This is where the math could get absolutely silly unless you take your buyback price sky high. We are now showing $1.6B of corporate EBITDA. If I leave the '22 buyback price at $100/share, we would be exiting '23 with only 4.9M shares remaining, and price target would go to $413, more than a 5-bagger. Once again, the repurchase is a huge part of the convexity. If I zero out the repurchase and stack cash, price target goes to $194. If I keep the huge repurchase but ratchet repurchase price up to $150, price target would go to $242, a lowly triple.

So there you are. Have I said anything particularly crazy in the above? Time will tell. I tried to be as fair as possible. A few points. A huge assumption is the “Recurring Value” of normalized FCF, which I have at $1.75B in all cases. This is a 7x FCF multiple on Met and 1x on Thermal. If you PV the remaining Met reserves at 7% and a normalized margin of $35/ton (which leaves $7/ton for recurring maintenance capex), you would spit out $2B. This fully excludes any contribution from Thermal even though Natty strip is above $3 for the foreseeable future. This also gives full freight to the $70M of corporate costs, probably a bad assumption if they were to fully divest Thermal.

Catalyst

3rd quarter earnings should be a positive catalyst for several reasons. First, Street estimates are laughably behind the curve (pun intended) and thus I would expect commentary around '22 negotiations to highlight the gap between consensus and reality, both in 4Q and into 2022. To further this point, the timing of the spike in Met and Thermal pricing could not be better, as we are in a heavy negotiating period and this will obviously influence the conversation. Tell me if the following exchange seems to reflect a management team feeling pretty good about upcoming negotiations, and this occurred on July 27th when Met was at $215 versus $390 today!

Second, there is an outside chance that the company could package a re-up on the repurchase authorization given the windfall of cash that is coming. This company repurchased $827M of stock in 2017-2019. With only $223M of authorization remaining and Leer South now officially shipping, it might make sense to announce an increased authorization on this call.

Finally, while the market had given up thermal for dead as recently as 3-6 months ago, there is a chance that this call brings a re-evaluation on that stance. Whether it is incremental PRB volumes versus prior expectations, realization that West Elk can tap seaborne or simply positive commentary on the margin convexity at recent higher prices, I think you could have a rethink of Thermal coming out of this call.

Risks

I just walked through 3 scenarios that had upside ranging from 85% to 400%. When something seems this good to be true, you have to poke holes. So let's do that.

1. Capital Allocation. The buybacks are adding a lot of the convexity, so lack of buyback could definitely have an impact, particularly to Scenario 2 and 3.

2. Longer Term Supply/Demand. The esteemed Andrew Cosgrove does think that we could start to see supply catch up to demand for Seaborne Met by the end of '22 and into '23. I feel comfortable given that this still leaves room for our scenarios above, PLUS the fact that I am totally comfortable owning this stock at normalized economics. Could we overshoot in ‘23 or ‘24? Of course, but how many shares are outstanding at that point and/or how much dividend income have we received?

3. Reclamation Costs. While the accounting value of the ARO is $213M, the bonded amount is $500M. Management has discussed in the past that the $500M has very little bearing on the actual economic obligation, but some prefer to shoot first and ask questions later on this topic. Especially in bear markets. If somebody wants to value the ARO at $500M, this would be $20 to the stock.

4. Chiiiiiiina - It is not a far leap of faith to look at what has happened to Iron Ore prices and be pretty concerned that Met could be impacted by China reducing Steel output. While "Scenario 1" does make me feel a bit more comfortable (I am essentially running 2017-2019 average Met margins through the model, adjusted for Leer South addition; this period wasn't exactly the Roaring 20's if you'll recall). If we are being honest with ourselves, if Spot met comes down $150 in a straight line, it will be hard for the stock to work until we are out the other end, even thought it's patently obvious this has to happen at some point in the next year. A tactical consideration, but one to consider nonetheless.

A couple quick nitpicks on the $ARCH post. First, I was working towards a free cash flow number and thus I excluded both ARO accretion and non-cash G&A. On the former, I feel fine as accretion is non-cash AND I backed out the ARO from the EV, so it is not 'missing'. On the latter, I should probably penalize the company in some fashion (I could simply just increase G&A, or I could grow the share count by a couple hundred thousand shares per year). If you want to keep it uber simple, just add about $10M to G&A per year (it's probably overly conservative as we are functionally 'selling' thermal in '23 by only capitalizing it at 1x, but I digress)

I will post separately about the convert and how we can handle that more cleanly than the way I initially modeled it later today