In front of the GreenFirst annual shareholders meeting and management Q&A, I wanted to throw some questions out to the metaverse as I will be unable to attend.

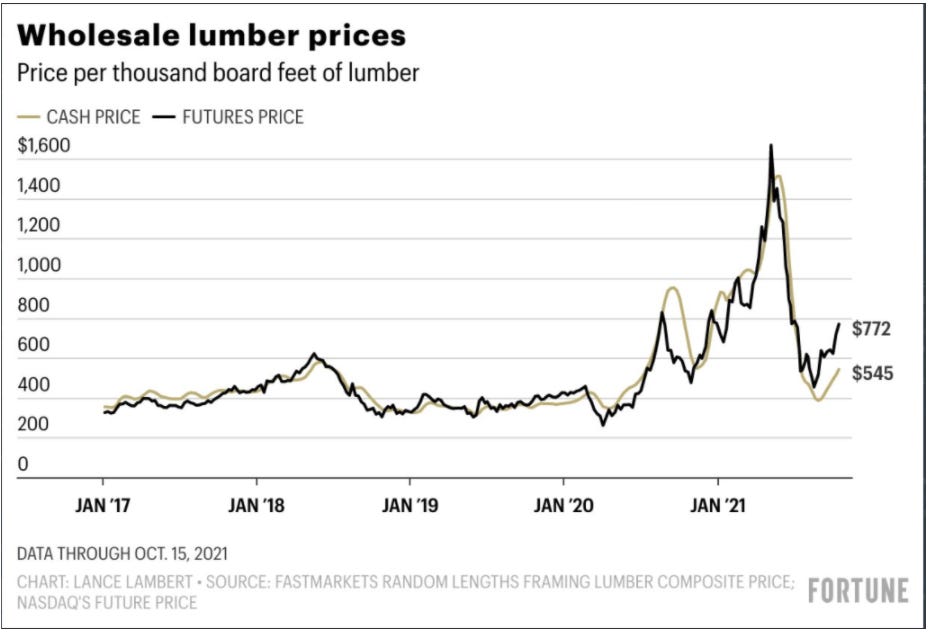

Frist some context, mea culpa on the short-term performance here. The stock is down about 12% since I posted and has dramatically under-performed higher Lumber prices. My thesis is that post-noise, this story will be all about Lumber prices and utilization, so I am clearly offsides in the short term. H/T @clownbuck for the chart below. Not a fun one.

East vs West

My biggest macro question is the changing dynamics between Eastern Canadian and BC production. With both cost and volume issues, it seems the relative positioning of Eastern assets has improved greatly, and the Interfor/Eacom deal further validated. How structural are these changing fortunes, what does it mean for the company longer term, does it impact capital allocation decisions (which we will discuss below)?

Kenora

The game plan to ramp Kenora to 150mmbf of production is reliant upon roughly doubling the size of the Timber Supply agreement the mill previous had with the Ontario Ministry of Natural Resources and Forestry. It has been crickets on this front; please provide an update.

In the company’s own words: “If the timber supply agreement granted by the Province of Ontario is for a lesser amount than the requested 650,000 m3 of softwood per year, the Company will have to assess whether the volume of timber is adequate to re-open the facility.”

Utilization

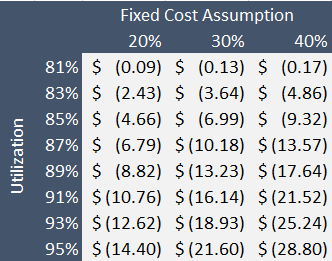

While the story around increasing utilization and reducing unit costs is very straightforward in principle, there is zero quantification, so this is a total guessing game. I tried to frame what would happen at various levels of fixed cost assumption and utilization increase, but this is a shot in the dark without better data. Could you please help understand how much unit cost reduction is possible, and how much is going to be eaten by inflationary wage pressures along the way?

Unit Cost Reduction at Various Levels of Utilization and Assumed Fixed Cost

RYAM lockup expiration

Management issued 28.9M shares to Rayonier in conjunction with the deal, which are locked up through the end of February. Would you be willing to purchase these assuming Lumber stays at these levels and free cash flow is as strong as I expect?

Capital Allocation

Aside from investing in the business to increase utilization and capacity, what is your framework for capital allocation, and please specifically explain how the framework would change in a ‘super-spike’ scenario? Is there a preference for share buyback or special dividends? Should the first $30-$50M of free cash flow go to debt paydown just in case this cycle is shorter or shallower than expected? Is there any more attractive M&A than your own stock at these levels?

Longer-term strategy beyond 2022/2023

Getting Kenora up and running and improving the RYAM utilization is no small task. If we get through to the other side, what is next? Where are the opportunities in the space? Are you content running profitable mills in one region and returning cash, or is there a broader strategy that maximizes shareholder return?

Uplisting

Are the costs associated with moving to a bigger exchange worth the increased liquidity in the stock?

Newsprint

What are we doing with newsprint? It has actually burned cash in recent history - what is the strategic value of keeping it?

Carbon Credits

What was the rationale for investing in Boreal? Separately, is there an angle to potentially create carbon credits (I thought it was the owner of timber that was best positioned for carbon credits)?

Cash versus CME

There seems to be a real disconnect between the Futures price and Cash recently. Is it fair to assume that the company is largely transacting at Cash?

Separately, in recent years, the rule of thumb of “CME plus $80/$90” has not really made it through to realized prices (I am showing anywhere from $0 to $40 versus CME). Is there some sort of basis I am not aware of? Management would do well to clear this up as this could set expectations far too high in the near future.

Did you get answers to these questions? I thought Mike was going to post them... I didn't see much to that effect.