$GFP.V: A Rivetting Opportunity

Some Serious Convexity to Stronger for Longer Lumber Prices

Summary

A cash shell buys a lumber mill. Investors generally like the deal and the stock works, but the company is still a microcap in a relatively niche industry with a large proportion of the investor base far afield from the operating asset. Said company then buys 5x more lumber capacity in a transaction several multiples larger than the original deal. A complicated rights transactions ensues. Chaos ensues.

This is Capital M Messy. I get it. Thankfully, when you look 6 to 12 months into the future, all of the mess will be a thing of the past and the two key drivers of the investment case will be sweet and simple - lumber prices and utilization. It is downright impossible and a fool’s errand to try to handicap short-term overhangs, so let’s spend our time modeling some operational improvement and various lumber prices, and see where we shake out. The range of outcomes with better utilization and even one year of strong lumber prices is quite attractive. At $700 Lumber (CME) for 1 year, then immediately transitioning to a long-term $500 and a 4.5x EBITDA multiple, the stock has 20%-25% upside depending on capital allocation. The convexity to stronger for longer Lumber is extreme. Using the same set of assumption but assuming $600 long-term Lumber, shares would have upside of 160%-210%. Ok fine, you need an EBITDA multiple? At $700 Lumber, the stock trades at 1.8x EBITDA (but keep in mind that EV is going to crater at the end of the year as you would end the year with >$100M of cash).

What I like even more is that this is a story littered with catalysts over the next 12 months. Through up-listing, reporting Sep-Dec results, improving utilization, paying down a material portion of deal-related debt and potentially holding an Analyst Day, you have a bunch of discrete steps that will reduce risk, confusion and illiquidity in short order.

Lumber Supply & Demand

The easiest argument to instantly “PASS” here is to simply look at the long-term CME chart. $450 Lumber and below simply doesn’t work for these assets. But if you believe that U.S. housing demand is in a sweet spot of 1.5M-1.6M starts in the foreseeable future, does that price history matter? Take a look at where starts were when Lumber was languishing. From 2012-2016, we averaged 1M housing starts. That is a far, far cry from our current situation, and the U.S. housing market is very well supported by strong demographics

Was the ramp in starts in 2020 and 2021 a one-off? This seems highly unlikely, and I will borrow the ‘money chart’ from @calculatedrisk. Demographics are destiny, as they say... but it’s much more than just that. We have consumer wealth and interest rates spraying gasoline on the fire of demographics.

But @twebs, surely U.S. housing is not the ONLY demand driver, correct? Yes, that’s right. The second largest demand driver is DIY/Remodel. Let’s have a quick chat with our good friend FRED for his opinion on the health of this customer:

Owner’s Equity a Cool TRIPLE versus 2012

HH Debt Service Chart Looks Like a Retailer Disputed by AMZN

Building Materials Retail Sales

But @twebs, you idiot, trees GROW. Supply will quickly catch up to any increase in demand. Let’s ask our little friend below what he had for lunch. Sadly, this beetle killed enormous amounts of Canadian trees1, and the industry was actually encouraged to use dead/dying trees up until about 2015. Keep that in mind when looking at the longer-term CME charts. You had a very long period of abnormally, and dare I say artificially, high SUPPLY.

[Excerpt from Footnoted Article]

Many pines killed by the beetle could still be harvested for a period of 5-10 years, and the government of British Columbia offered incentives to the industry to process these dead trees. Mason thinks roughly 800 million cubic meters of dead pine was harvested over a period of 15-odd years, until 2015 or thereabouts. But once that was done, forests had to regrow.” We’re talking about a diminished harvest in British Columbia for decades,” Mason says.

The supply of “fibre”—the lumber industry ‘s term for harvested wood—slowed so much that many sawmills shut down. In fact, Mason thinks that, for a normal year, there are still too many sawmills operating relative to demand. “There’s still another billion board feet of capacity that needs to come out of British Columbia.”

Through most of the last decade, the slowed supply of lumber from British Columbia matched a lethargy in demand in the US. In 2005, the US consumed nearly 65 billion board feet of wood, but after the recession hit, demand hit a trough in 2009: 33 billion board feet. Things recovered very slowly, Jannke said. “In 2019, it was barely back to 50 billion.”

Jannke suspects that, last year, demand for lumber in the US was between 52 and 55 billion board feet, still far below the peak of 2005. In an ordinary year, those needs would have been easily met. But the combination of the pandemic and the shrunken capacity of British Columbian production have muffled supply.

Utilization

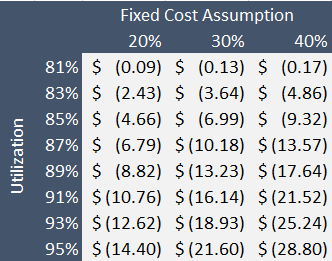

There is no sugar-coating this - the Tembec assets that GFP purchased from Rayonier have had poor operational performance for a long-time. 82% utilization in 2019. 81% in 2020. As Lumber was absolutely mooning in the first half of this year and you could have paid the hourly rate of the Toronto Raptors and still made money, utilization surely spiked, correct? How about 76% in the 1st quarter and 83% in the 2nd quarter. GFP management have made it VERY clear that operational improvement is at the core of the purchase thesis here. A quick look at what happens when you improve utilization is crucial. Depending on your assumption of fixed costs and utilization improvement, costs could be reduced by up to $30 per thousand board foot - not to mention the benefit of selling a lot more Lumber. Think of this as substantial downside protection (as you reduce your breakeven cost) and built-in revenue generation on higher production. Rather than wasting a ton of words, let’s just look at the sensitivity table.

Cost Reduction with Improving Utilization

Please note the reason I don’t have fixed costs nailed down is due to the lack of disclosure on RYAM’s part - this was all I could find in re: costs of production. Wood fiber and energy are explicitly called out as 50% of the cost structure, whereas Labor (should be largely fixed based on management commentary), manufacturing and maintenance supplies, overhead (fixed) and transport costs are not quantified.

The Numbers

So let’s just back up the truck a bit. The stock seems to be embedding some sort of return to substantially lower Lumber prices… “Just look at the long term chart”. But I just walked you through 3 reasons why the long-term chart is almost meaningless. Starts are 50-70% higher than some of the fallow years. Home improvement impulse is already strong and supported by insane amounts of home equity and incredibly strong consumer balance sheets. The Canadian government, IN A TERRIBLE DEMAND BACKDROP, was incentivizing incremental supply in order to deal with the beetle issue. These all seem to be reasons to simply tear up the old price charts. Yet the stock doesn’t tell you that, at all - let’s have a look…

I am sure there are many smarter than me who can slice and dice supply/demand in a much more thorough way. What I do know, however, is that we just walked through some pretty obvious reasons to be bullish on both the supply and demand side. What I do know is that there was probably some mix of hype and transitory factors that caused the super-spike in May… however, there also seem to be some very real stronger for longer vibes in this market. As with many other commodity-linked equities, the market seems to price in an immediate and dramatic drop back to a substantially lower price deck. I am going to take the other side of this bet and assume that $500 or $600 is the ‘new normalized’ Lumber price in some scenarios below. I get it, pull up a longer-term chart on Bloomberg and there is a lot of time spent in the $300s and $400s. Here is an alternate way to look at the historical price - let’s plot average annual price since 2012 versus starts. Not nearly as scary right. (The only thing scary here is the chart crime I have surely committed)

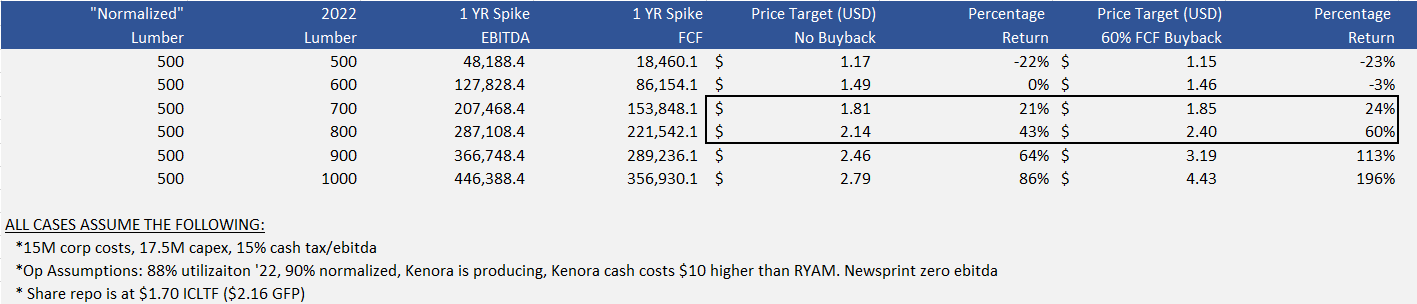

I am approaching GFP in much the same way as ARCH2 - “ok fine, I will simply run 1 year of strong pricing through my model3, then throw a multiple on normalized EBITDA at normalized Lumber. The first chart below is what happens if you choose $500 as your normalized Lumber price. The ranges of outcome if next year averages anywhere from $500-$1000 (vs nearest CME future @ $760) is down 22% to up 196%. I placed a border around the $700/$800 cases given where CME futures are trading.

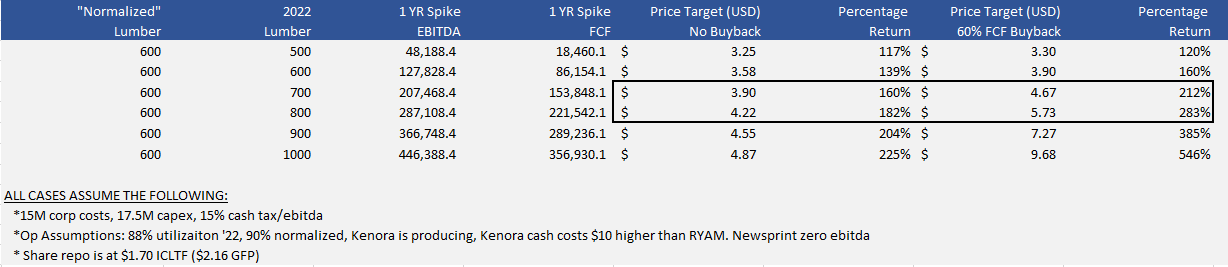

The $600 normalized Lumber scenario is where things start to get spicy. We are now talking about an explosive range of outcomes, with USD price ranging from $3.25 - $9.68, i.e. more than a double on the low-end and a 6.5x bagger on the high end. Is this insane? Well a couple sanity checks. First, the 4.5x EBITDA multiple on $600 Lumber would equate to a 31% FCF yield. Second, we just had BC producers curtail production when CME kissed $500 for a hot second. I have seen analysts that estimate BC break-evens in the $500-$550 range. Finally, there is a ton of alignment with shareholders here - the Chairman and CEO own a boatload of stock and warrants, and this board is unlikely to ignore the narrative4 that capital allocation can magnify equity returns.

Below is a sample simplified income statement keyed on the $700/$600 scenario. One thing I did want to highlight is that I am only using $40 above CME for realized pricing. While I know ESPF can average $80-$90 above CME, I have found that the GFP historical data is much more narrow - maybe there is basis elsewhere that I am not understanding, or maybe I am just daft. I hope I am wrong and this is overly conservative. Second, I have diluted share count at 209M. I ignored the cash inflow that will come in when Chairman/CEO and Senvest exercise their warrants, so I am probably something like $20M conservative in this assumption as well (call it a contingency)!

Risks

Wait, you really thought it could be this easy? Of course not! Let’s be perfectly clear, this story is not without its risks. As I just learned with the AMPY fiasco, there are operational concerns that any ‘real-world’ business faces that basically go without saying. Below I will list what else keeps me up at night, hopefully in reasonable order.

Kenora - The game plan to ramp Kenora to 150mmbf of production is reliant upon roughly doubling the size of the Timber Supply agreement the mill previous had with the Ontario Ministry of Natural Resources and Forestry. It has been crickets on this front, and I am not sure how to handicap whether this is a problem or not. In the company’s own words: “If the timber supply agreement granted by the Province of Ontario is for a lesser amount than the requested 650,000 m3 of softwood per year, the Company will have to assess whether the volume of timber is adequate to re-open the facility.”

Cost Curve - this may be more of a gap in my understanding as opposed to an actual risk, but it seems to me that based on looking at public companies, there is not an incredibly steep cost curve in Lumber. When I think about ARCH and its top-quality High Vol A coking coal reserves, I gain great comfort that they are at the low end of a steep cost curve globally. This means that prices can fall in a way that a lot of capacity is rendered unprofitable, yet ARCH is still cash flow positive as the market heals itself by taking out some of the top quartile production. In Lumber, it seems a lot of the public companies have reasonably similar cost curves, i.e. within something like $50 of each other. [Editors note, if anybody can help with average cash costs of various regions, that would be super helpful as I’ve really struggled to understand costs by geography since most public players own capacity all over North America]

Cash vs Futures Gap - The ‘cash’ market is currently below the near-month futures price on the screen. While these need to converge as time moves on, when you have a dynamic like this there is a chance that the sawmills print a larger than normal discount to CME come earnings time. HT @newslambert

Rayonier Overhang - As part of the purchase price to RYAM, GFP issued 28 million shares which RYAM agreed to hold for a period of 6 months. This could cause an overhang particularly if RYAM were to try to bleed the shares out, as the liquidity on the stock is quite challenged and there is heavy insider ownership.

https://qz.com/1985276/america-is-running-short-of-wood/

Quick note - I am running the “one strong year'“ as Calendar ‘22 in the model, but it is realistically more like Q4 ‘21 through Q3 ‘22. I believe the company had $80M of net debt at deal close and I am ‘starting’ ‘22 at $40M of net debt, aka I am basically modeling a ‘normal’ Sep-Dec. So my timing is slightly off, but I don’t feel like building a quarterly model! Don’t shoot me, boss.

See what I did there

Like everything I have seen from you so far, this is great. Great run up in lumber and crickets on the stock. I think this is a team where buy backs at low prices are very likely.

What do you think of the YAVB podcast with Mike Mitchell, Greenfirst's connection with Kyle Cerminara and the negative articles relating to Kyle Cerminara by Roddy Boyd and The Bear Cave?